Is This Dividend Stock Still a Buy After Rising Nearly 46% in 3 Months?

There has been a stellar rally in U.S. stocks from their April lows, as President Donald Trump scaled back his tariff rhetoric, which at one point threatened to disrupt not only the U.S. economy, but also shake up global supply chains.

Specifically, Citigroup (C) shares are up nearly 46% over the last three months. The stock has not only recouped its 2025 losses, but is outperforming the S&P 500 Index ($SPX) with YTD gains of 31.6%. In my previous article, I had noted that Citi looked like a good buy given its attractive dividend yield and potential for capital appreciation. In this one, we’ll examine the stock’s outlook after the recent rally that catapulted it to a 52-week high on July 22.

Citi Reported Strong Earnings for Q2

Citi reported a strong set of numbers for Q2 2025 with revenues rising 9% year-over-year after adjusting for the impact of divestitures. Its net income grew 25% over the period, and like revenues, it too topped Street estimates. The results helped justify the stock’s YTD outperformance and were a testimony to the successful turnaround under CEO Jane Fraser.

As Fraser aptly said in her prepared remarks, the Q2 results “continue to demonstrate that our strong results are sustainable through different environments.”

America’s fourth-largest bank by assets reported a return on total capital employed (ROTCE) of 8.7% in Q2, and Fraser reiterated that the 10%-11% target that the bank has set for 2026 “is a waypoint, not a destination.” She added, “The actions we’ve taken have set up Citi to succeed long term, drive returns above that level and continue to create value for shareholders.”

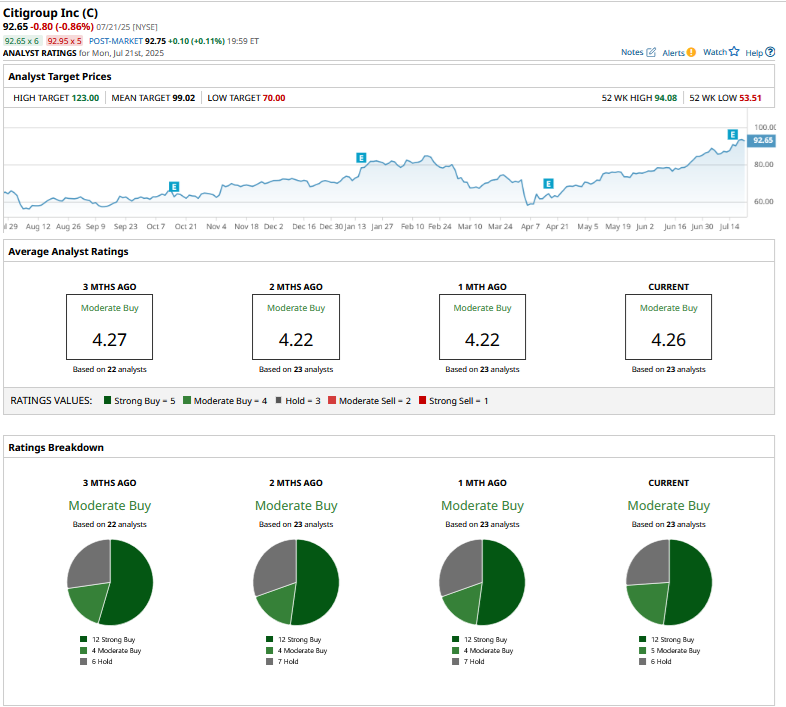

Citi Stock Forecast

After Citi’s impressive Q2 earnings, several brokerages raised the stock’s target price, with Oppenheimer raising it to a Street-high of $123. DBS, which had a rating of “Hold” on Citi before the earnings, upgraded the stock to a “Moderate Buy,” which coincides with the stock’s consensus rating from the 23 analysts polled by Barchart.

Citi Increased Its Dividends

Citi has been quite generous with sharing its success with investors, and during Q2 the company returned nearly $3.1 billion to shareholders, representing a payout ratio of 82%. Of these $2 billion was towards share repurchases as part of the $20 billion buyback plan, while the remaining was for dividends.

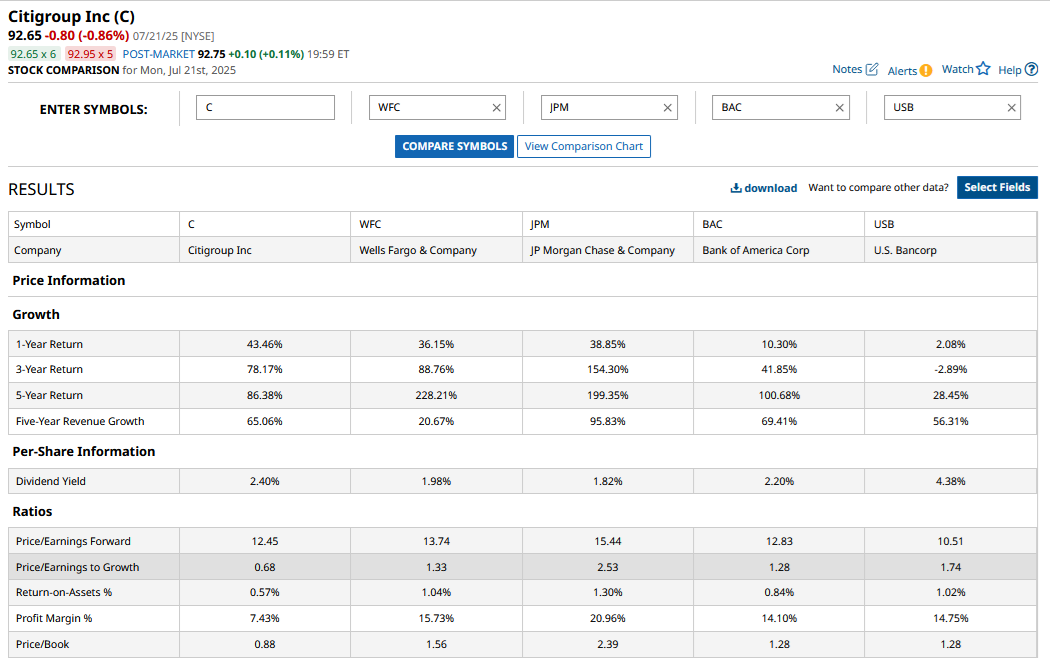

During the earnings call, Citi announced that beginning the third quarter, the company will increase the quarterly dividend to 60 cents, 7.1% higher than the current payout. This gives us a forward dividend yield of nearly 2.6% which, while lower than the average yield over the last few years, is still higher than most of its peers in the large-cap banking space.

For instance, JP Morgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC) – the top three U.S. banks by assets in that order – have dividend yields of 1.9%, 2.2%, and 2.0%, respectively.

C Stock Still Trades at a Discount to Peers

During Q2, Citi’s book value increased 7% YoY to $106.94 while the tangible book value rose 8% to $94.16. The gap between Citi’s stock price and tangible book value has all but vanished as the shares have nearly doubled over the last two years.

However, it still trades considerably below its book value, which is a sign of undervaluation in banking stocks. Citi’s U.S. banking peers trade above their book value, and while C stock has inched towards its book value as markets give a thumbs up to its transformation measures, it still has some catching up to do.

As Citi’s margin and return multiples – that are arguably below other banks – improve further, there is further scope for an expansion in its valuation multiples.

Should You Buy Citigroup Shares?

I still see scope for a further valuation rerating for Citi. However, at these levels, the margin of safety is somewhat low in the stock, and with the looming Aug. 1 tariff deadline, I would be wary of adding more C shares here. However, I continue to stay invested in Citi while waiting for an opportune price level to add more shares to existing positions.

On the date of publication, Mohit Oberoi had a position in: C , BAC . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.